Time to read: 9 min

The global supply chain has experienced severe disruptions in recent years, due to shutdowns and restrictions related to the COVID-19 pandemic, political changes, the wars in Ukraine and Israel, and an evolving business landscape.

Slowdowns, rising prices, and logistical challenges have caused everyday supply chain processes and supplier relationships to change. But while leaders talk about where to go next, the supply chain must be maintained and goods must reach the end consumer.

On-demand manufacturing enables organizations to serve local markets, and digital fabrication technologies open up new roads to successful innovation. Cloud-based software platforms allow some supply chain employees to collaborate from home, and artificial intelligence is advancing to better optimize and streamline all digitized information processes.

How can companies achieve an agile and resilient supply chain amid obstacles and unpredictability? These important supply chain statistics will provide insight into the future of supply chain management and give you a competitive advantage.

Key Supply Chain Statistics

Our research uncovered three primary findings that offer essential insights into the current state of the supply chain, as well as inform strategies that will help organizations meet tomorrow’s challenges.

These findings explore the following:

- The consequences of supply chain disruptions (financial, reputational, etc.).

- The importance of end-to-end visibility.

- How organizations along the supply chain are responding to emerging technologies like artificial intelligence (AI).

Much of the data in this article is included in our 2023 State of Manufacturing report. The rest comes from other credible sources. The following is a detailed breakdown of all three key findings.

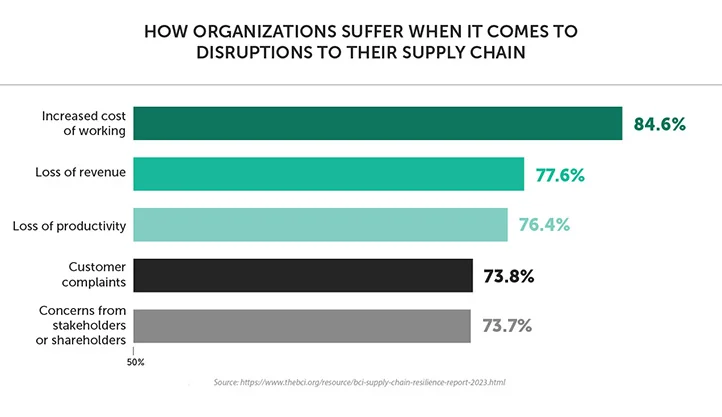

1. Increased cost of working is the leading consequence of supply chain disruptions, at 84.6% (Source)

Furthermore, the survey by the Business Continuity Institute discovered a tie for second and third place, with 54% of respondents reporting negative impacts on both logistics and reputation.

According to the report, different types of disruptions tend to lead to different types of costs. For example, adverse weather affects logistics costs for 62% of respondents, while cybercrime is more likely to cause financial (70%) and reputational (60%) damage.

Meanwhile, incidents related to health and safety tend to lead to increased costs in all three areas, with 68% of respondents experiencing negative financial impact, 68% suffering reputational damage, and 64% experiencing logistical consequences.

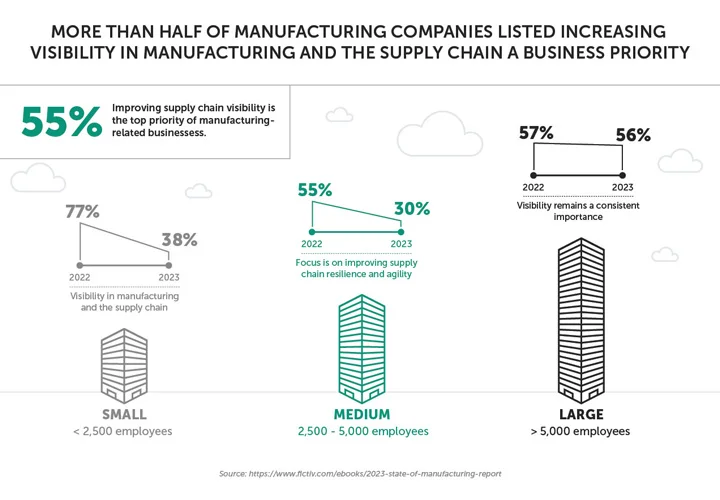

2. Improving supply chain visibility is the top priority for 55% of manufacturing-related businesses (Source)

For a resilient and agile supply chain, visibility is key to optimizing complex processes. Having a clear view of where goods and products are in the supply chain at any moment helps reduce disruptions, increase efficiency, and improve inventory management. This also includes supplier readiness and lead time forecasts.

Transitioning to a supplier ecosystem decentralizes the responsibility of managing increasingly complex supply chains. This increased autonomy among suppliers, and the ability for relationships to form among them, allows for a tighter and more integrated supply chain, rather than a drawn-out chain where it can be difficult to see what’s happening down the line.

This is reflected in our findings in our latest State of Manufacturing report. For the second year in a row, more than half of manufacturing companies overall listed increasing visibility in manufacturing and the supply chain as a top business priority.

However, for smaller organizations with fewer than 2,500 employees, this priority has slipped significantly in the rankings, from 77% in 2022 to 38% in 2023. Instead, business priorities for smaller companies in 2023 are improving customer experience at 52% and reducing operational inefficiencies at 45%.

Increasing the speed of new product innovation is the second-highest priority for companies overall, with 49% of companies of all sizes listing this as a priority in 2023. This is a steep increase over the previous year, when just 11% of companies listed this as a priority.

For medium-sized businesses with 2,500 to 5,000 employees, the focus in 2023 is on improving supply chain resilience and agility, at 55% (up from 30% the previous year).

As for companies with more than 5,000 employees, priorities remain consistent, with visibility in the top spot at 56% (a drop of 1 percentage point over the previous year).

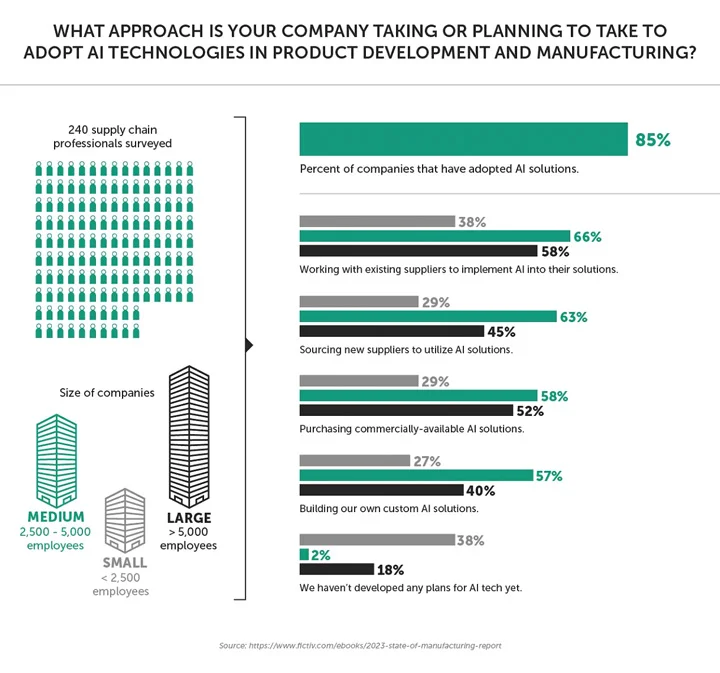

3. 85% of leaders in engineering, supply chain, manufacturing, and product development plan to or have adopted AI (Source)

Our survey of 240 supply chain professionals in these roles found that those at the executive level tend to be more excited about implementing AI technology than director-level leaders. Only about half of leaders at the director level are excited about artificial intelligence, and they are four times more likely to be worried about emerging AI technologies.

As for where AI will have the most impact, 60% of engineering leaders who responded to our survey believe it will affect quality control inspections, where AI has been broadly implemented for the better part of a decade. This is in contrast to 47% of respondents in non-engineering roles who said the same.

Leaders in non-engineering roles are more likely to expect AI to play a part in product design, where its potential is just beginning to be explored (51% vs. 36%). They’re also more likely to see uses for AI in supply chain management (51% vs. 38%).

As AI drives advancements in automation and robotics, most respondents are working with existing suppliers to implement AI solutions, but nearly as many are finding new suppliers, implementing commercial AI solutions, or building their own.

Additional Supply Chain Statistics

Here are 34 additional supply chain statistics that provide further insight and context into our three key findings, as well as other current and future challenges facing the supply chain industry.

Additionally, these stats reveal victories being achieved by organizations along the supply chain, as well as areas that can be improved for a competitive edge.

Sustainability

1. 48% of companies say they are under increasing pressure to improve sustainability in the supply chain. (Source)

2. Three main challenges companies face in meeting sustainability goals are limited control over sustainability standards of suppliers and partners (54%), difficulty scaling initiatives that work on a smaller scale (40%), and lack of funding (36%). (Source)

3. Sustainability initiatives are focused primarily on electrification (40%), natural resource management (29%), water usage (27%), renewable energy (27%), and Scope 3 emissions, which the company does not produce directly but is responsible for (23%). (Source)

Market Growth

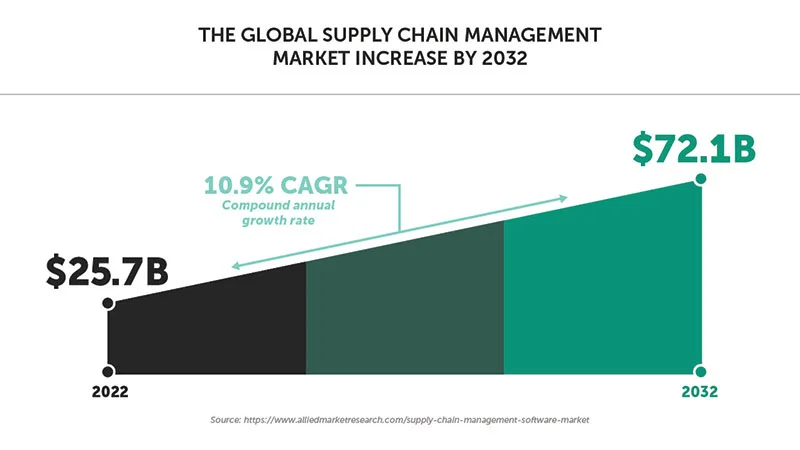

4. The global supply chain management market will increase from $25.7 billion in 2022 to $72.1 billion in 2032, forecasting a compound annual growth rate (CAGR) of 10.9%. (Source)

5. The massive growth rate of the supply chain management industry is partly due to the expansion of e-commerce, automation, and digital transformation during the COVID-19 pandemic. (Source)

Supply Chain Challenges

6. The biggest challenges facing supply chain operations are hiring and retainment (57%), talent shortages (56%), disruptions (54%), running out of stock (52%), and consumer demands (52%). (Source)

7. To address supply chain challenges, companies are reskilling and upskilling workers (41%) and hiring new workers with future-facing skill sets (34%). (Source)

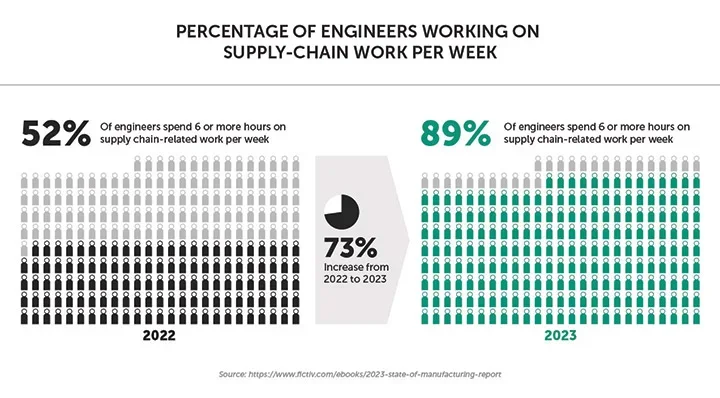

8. 52% of engineers spend 6 or more hours on supply chain-related work per week, including sourcing vendors, providing and requesting quotes, and ordering parts. This is a staggering 73% increase from 2022 to 2023. (Source)

Inventory Tracking

9. 43% of small businesses use outdated inventory tracking methods, like pen and paper (14%) and spreadsheets like Excel (21%). (Source)

10. 8% of small businesses do not track their inventory at all. (Source)

11. Only 33% of small businesses use inventory management software or do the inventory directly in their accounting software, Quickbooks. However, it’s important to note that 24% of small businesses don’t have inventory. (Source)

Outsourcing

12. 42% of businesses are increasing outsourcing in engineering, in response to a shortage in mechanical engineering talent. (Source)

13. An alarming 97% of supply chain leaders expect a growing shortage of talent fit for mechanical engineering roles. (Source)

Offshoring vs US-Based Manufacturing

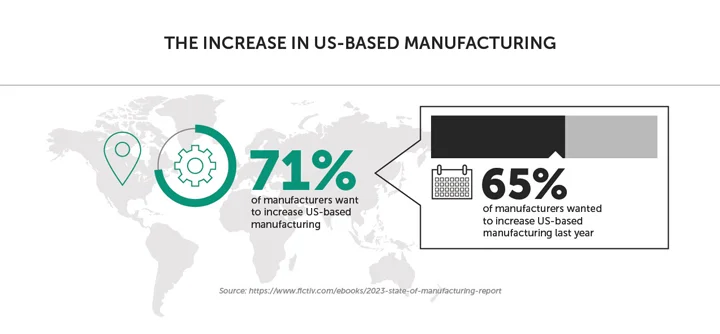

14. 71% of manufacturers want to increase US-based manufacturing, an increase from 65% of respondents the previous year. (Source)

15. Meanwhile, 51% of manufacturers want to engage in near-shoring to keep manufacturing on the North American continent, up from 48% the year before. (Source)

16. Fewer manufacturers want to diversify global manufacturing operations through offshoring, at 44% down from 52% the previous year. (Source)

Maritime Trade

17. 90% of international trade, and 76% of all US trade, involves maritime traffic. (Source)

18. $1.5 trillion in goods are shipped in and out of American ports each year. (Source)

19. 13 million workers depend on American ports for their jobs. (Source)

20. There are 15,000 miles of commercially navigable US waterways. (Source)

21. An extra inch of water depth can allow shipping companies to add an extra 58,000 pairs of shoes with a value of $5 million. (Source)

22. Annually, 11 billion tons of goods are shipped across the world’s oceans, representing 1.35 tons of goods per person. (Source)

23. In The Netherlands, Spain, the UK, Italy, Germany, Belgium, France, Sweden, Poland, and Ireland, shipping fleets produce a larger carbon footprint than all the cars in the country. (Source)

Effects of Brexit

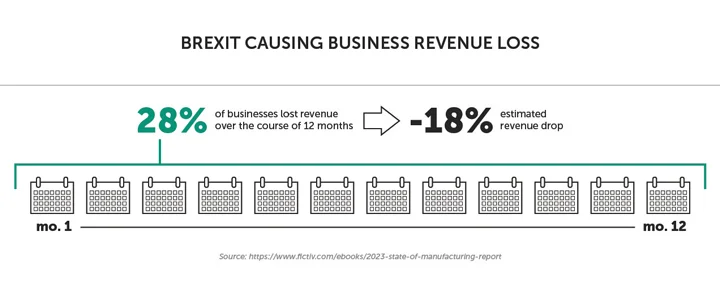

24. Brexit is affecting the bottom line for businesses on the supply chain, with 28% losing revenue over the course of 12 months at an estimated revenue drop of 18%. (Source)

25. 83% of UK businesses say supply chain disruptions caused by Brexit will get worse. (Source)

26. 80% of UK businesses believe that the decision to break ties with the EU has been the greatest disruptor to the supply chain, even larger than the war in Ukraine (76%) and COVID-19 (59%). (Source)

27. More than that, 51% of UK respondents believe they might go out of business due to Brexit, and 69% are concerned their suppliers may go out of business. (Source)

28. 83% of UK manufacturers report that disruptions caused by Brexit have severely hampered new product innovation. (Source)

Responses to COVID-19

29. 75% of companies on the supply chain are changing practices based on lessons learned from the pandemic. (Source)

30. 41% of logistics companies are making moderate changes following the pandemic, and 34% are making extreme changes to their supply chain management procedures. Meanwhile, 25% are making few or no changes. (Source)

31. To accommodate remote-working practices, 58% of companies are implementing new human resources policies and 61% are working on establishing better IT capabilities such as cloud-based systems for remote collaboration. (Source)

32. 58% of companies are intensifying their risk management in response to the pandemic, while 46% are implementing new sourcing strategies, 37% are improving their inventory management, and 26% are making changes to transportation. (Source)

Adapting to Low-Volume Builds

33. 56% of supply chain leaders list sourcing for low-volume builds as the biggest barrier to innovation, a 30% increase over the last two years. (Source)

34. 78% are looking into technology solutions to increase operational efficiency for new product development. This will make delivering low-volume product batches significantly more viable. (Source)

What we can learn from our key findings and the additional supply chain statistics

Navigating supply chain challenges requires finding new ways forward. Here are key steps to a more agile, resilient, and efficient supply chain:

- Embrace emerging trends and technology like AI, machine learning, and on-demand manufacturing

- Improve end-to-end visibility

- Accurately track inventory with modern tools

- Streamline processes

- Take procurement and sourcing off engineers’ hands so they can focus on what they do best

It’s important to stay open-minded when it comes to emerging trends and supply chain technology and find ways to leverage them to address vulnerabilities. For example, new technology solutions will make delivering low-volume product batches significantly more viable.

Additionally, partnering with an on-demand manufacturing partner to locally produce series can serve a market with specific wishes and requirements, plus it can eliminate the need for warehousing and stockkeeping.

With advanced prediction tools, AI can leverage data analytics to emulate different scenarios to determine which factories and distribution centers to deploy for which markets. It can also partially automate decision-making based on historical datasets.

AI systems will not replace human thought and creativity, but these are valuable tools for the future of the supply chain. Additionally, on-demand manufacturing won’t replace mass manufacturing, but it increases agility and creates new opportunities for improving time to market.

Further, visibility is key for supply chain network optimization, and so is tracking inventory levels and replacing spreadsheets for modern solutions that offer capabilities like transportation and warehouse management systems, data sharing, demand planning/forecasting, and inventory management.

While disruptions like the pandemic, war, and geopolitical events cause obstacles for the supply chain, with the right strategies and solutions there is a way forward.

Fictiv — Helping solve your supply chain challenges

Fictiv is the operating system for custom manufacturing that makes it faster, easier, and more efficient to source and supply mechanical parts. Its intelligent platform, supported by best-in-class operations talent, orchestrates a network of highly vetted and managed partners around the globe for fast, high-quality manufacturing, from quote to delivery. To date, Fictiv has manufactured more than 25 million parts for early-stage companies and large enterprises alike, helping them innovate with agility and get products to market faster.

Fictiv’s portfolio of optimized manufacturing services includes 3D printing, CNC machining, urethane casting, and injection molding.