Time to read: 10 min

The manufacturing industry plays a vital role in the global economy, driving innovation and providing millions of jobs.

Tracking the evolution of this sector helps businesses anticipate market trends, enables policymakers to craft informed regulations, and empowers investors to identify emerging opportunities.

At Fictiv, we have compiled key manufacturing industry statistics and trends that will shape the industry in 2024, helping you stay informed and prepared for whatever lies ahead.

From technological advancements and changes in labor, to shifts in international trade, these insights will give you a comprehensive overview of the state of manufacturing.

Key Manufacturing Industry Statistics

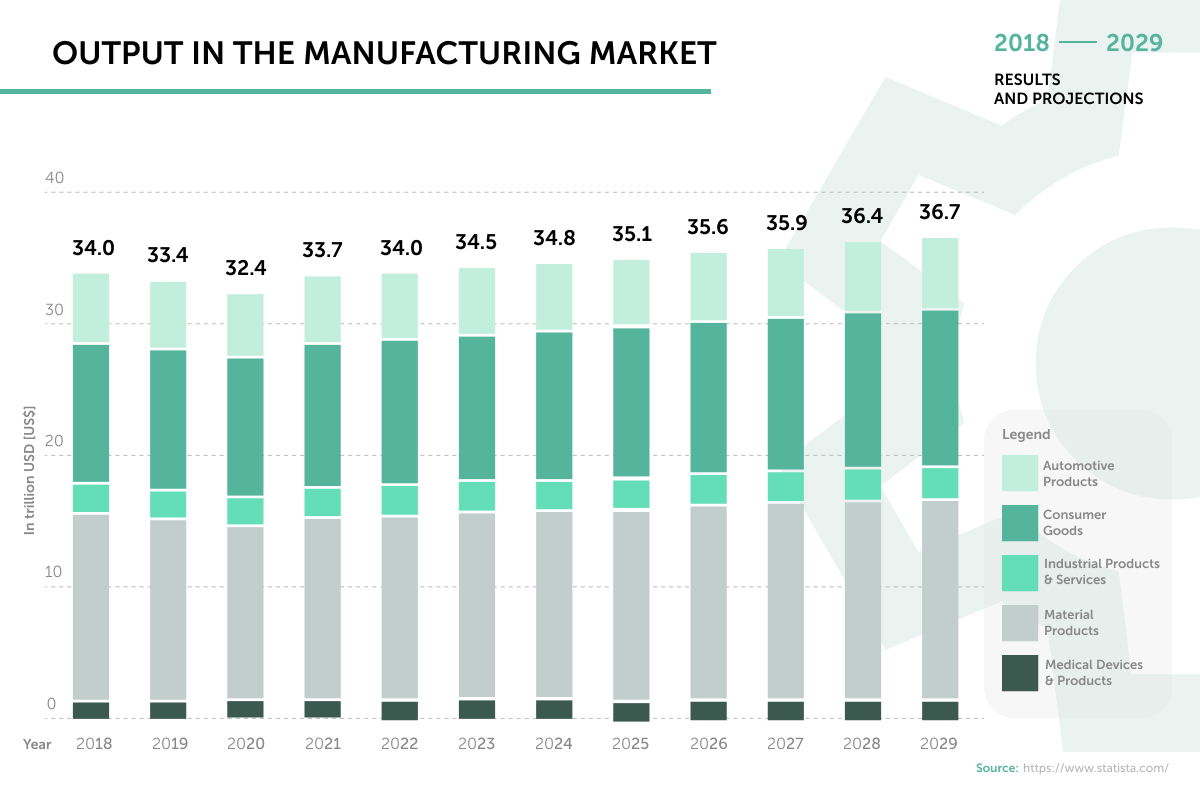

Here are five key findings that will likely have the greatest impact on the manufacturing industry moving forward: 1. Output in the manufacturing market is projected to reach a record $34.8 trillion in 2024 (Source)

This is an increase from $34.5 trillion in 2023. Looking ahead, that dollar amount is expected to reach $36.7 trillion by 2029 at a compound annual growth rate (CAGR) of 1.01%.

Here’s a breakdown of manufacturing output in the leading industries in 2024 compared to projections for 2029:

- Material products: $14.3 trillion to $15.1 trillion (5.6% increase)

- Consumer goods: $11.4 trillion to $12.1 trillion (6.1% increase)

- Automotive products: $5.2 trillion to $5.5 trillion (5.8% increase)

- Industrial products and services: $2.4 trillion to $2.5 trillion (4.2% increase)

- Medical devices and products: $1.4 trillion to $1.5 trillion (7.1% increase)

The massive size of the manufacturing industry highlights the sector’s critical role in the global economy. Growing output reflects robust consumer demand and the continuous expansion of manufacturing capabilities across various regions.

To sustain and increase this output, businesses must prioritize innovation, efficiency, and sustainability, supporting long-term growth and competitiveness in the global market.

2. The manufacturing sector contributed a record-breaking $2.8 trillion to the U.S. GDP (gross domestic product) in 2023 (Source)

According to a March 2024 report from Statista, the value added in 2023 increased slightly over the previous year, up from $2.79 trillion in 2022.

However, this is after a significant leap from $2.5 trillion in 2021, as the world was recovering from the COVID-19 pandemic and related labor, commerce, and supply chain disruptions.

Note: Value added is an economic term that measures the contribution of a manufacturing industry to a country’s gross domestic product (GDP). It is calculated by subtracting the cost of materials and supplies used to produce goods from the value of those goods.

By comparison, at the turn of the century, the manufacturing sector contributed $1.55 trillion to the U.S. GDP ($2.83 trillion adjusted for inflation).

Manufacturing plays a critical role in the country’s overall economic health, and the sector is vital for driving growth, innovation, and employment.

The recovery from 2020 to 2021, and skyrocketing value from 2021 to 2022, show the sector’s resilience and ability to adapt to world events and a changing market.

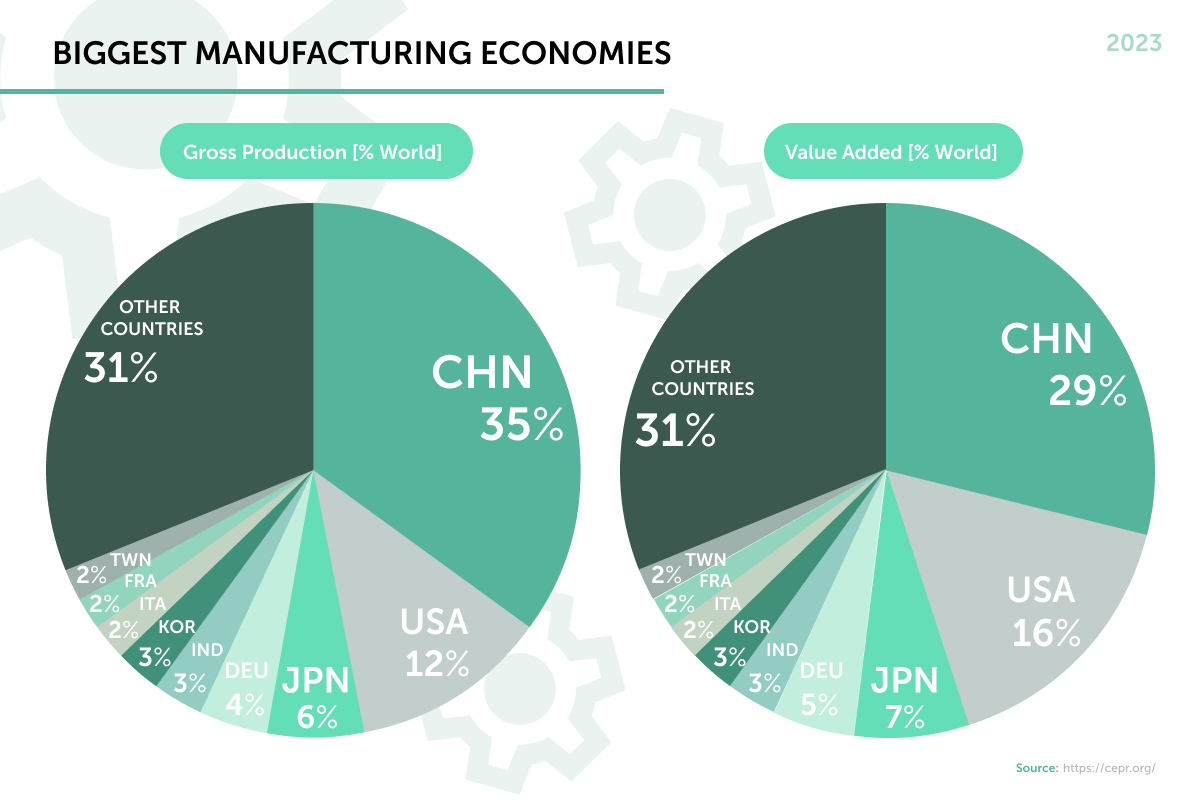

3. China leads in global manufacturing (35%) and value-added (29%) (Source)

China now accounts for nearly triple the gross production of the United States, which comes in second at 12%. Gross production equals the total sales from manufacturers in that country.

The other top producers are Japan (6%), Germany (4%), India (3%), and South Korea (3%). Italy, France, and Taiwan are each responsible for 2% of gross production, and the rest of the world produces a combined 31%.

Meanwhile, China generates nearly twice as much value added as the U.S. with 29% of the global total versus 16%. Recall that value added is the net output after subtracting intermediate inputs.

Rounding out the other top contributors of value added are Japan (7%), Germany (5%), South Korea (3%), and India (3%). Italy, France, and Great Britain are tied with 2% each. The rest of the world generates 31% of value added.

Significantly, many of these countries have newly industrialized economies. Meanwhile, four nations in the G7 either aren’t on the charts or don’t represent more than 2% of the global share (Canada, France, Italy, and the United Kingdom).

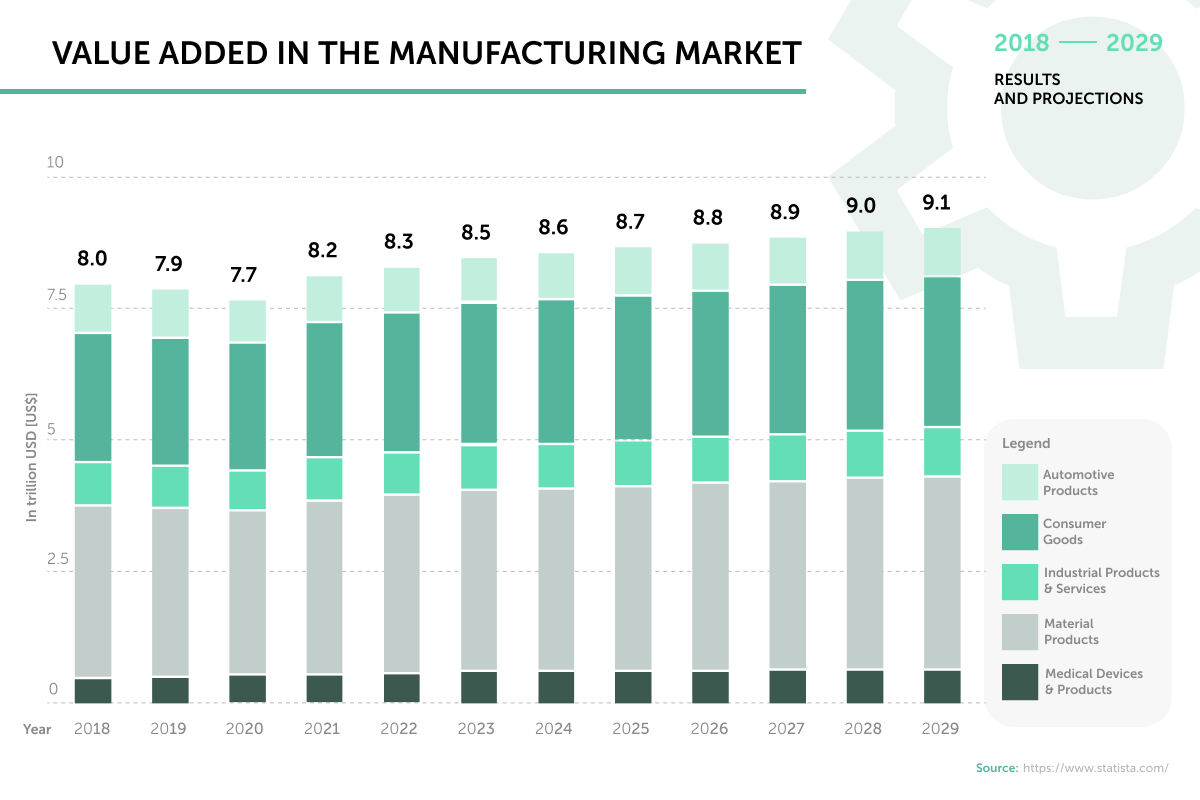

4. Value added in the global manufacturing market is projected to reach $9.1 trillion in 2029 at a 1.09% CAGR (Source)

In 2024 the total value added reached a record $8.6 trillion, up from $8.5 trillion the previous year. Over the past few years, the total annual increase has been approximately $100 billion, and this trend is expected to continue.

Here’s how this breaks down by segment or subsector, and the projected increase over the next five years:

- Material products (raw materials): $3.5 trillion to $3.7 trillion (5.7% increase)

- Consumer goods: $2.8 trillion to $2.9 trillion (3.6% increase)

- Automotive products: Steady at $900 billion

- Industrial products and services: Steady at $900 billion

- Medical devices and products: Steady at $600 billion

Interestingly, the projected growth is localized to material products and consumer goods, while other segments are expected to remain steady.

The relatively consistent value added growth reflects the continuous advancements in manufacturing technologies, increased demand for goods, and expansion into new markets.

As industries adapt to changing consumer needs and invest in innovative solutions, the manufacturing sector remains a cornerstone of economic development worldwide.

According to a report by Mintel, consumers will place increasing value on sustainability, durability, and overall flexibility, which likely will help drive this growth.

5. The number of enterprises in the manufacturing market will reach a record 5.52 million in 2024 (Source)

The number of enterprises is expected to grow to 6.14 million in 2029, at a 2.15% CAGR.

Here’s a look at how each segment is expected to grow between 2024 and 2029:

- Material products: 2.28 million to 2.66 million (16.7% increase)

- Consumer goods: 2.23 million to 2.47 million (10.8% increase)

- Industrial products and services: 650,000 to 720,000 (10.8% increase)

- Automotive products: 140,000 to 150,000 (7.1% increase)

- Medical devices and products: 120,000 to 140,000 (16.7% increase)

The projected growth in enterprises from 2024 to 2029 (11.2%) is more than double the growth from 2018 to 2024 (5.1%). This reflects the need for new enterprises to meet demand as consumer spending bounces back from COVID-19, inflation, and other economic troubles.

U.S. Manufacturing Job Statistics

Manufacturing accounts for a large portion of jobs in the United States. Here are the most important manufacturing job statistics from the U.S. Bureau of Labor Statistics and other sources.

- As of June 2024, manufacturing jobs employed approximately 12,9 million people in the United States, an increase from 12.7 million people in 2022.

- The transportation equipment manufacturing industry is the largest manufacturing employer in the U.S., leading in 16 states. This is followed by food manufacturing, which leads in 19 states and Washington, D.C.

- California employs more manufacturing workers than any other state, with 1.3 million workers representing 8.7% of the California workforce. This is largely driven by the manufacture of computer and electronic products. Texas is second with 925,394 manufacturing employees, at 8.2% of the state workforce with a focus on fabricated metal products.

- Indiana, Wisconsin, and Iowa have the highest concentration of manufacturing employment in the United States. In Indiana, 19.8% of all employees are in manufacturing. This number is 19% for Wisconsin and 17.2% for Iowa.

- The average hourly wage in the manufacturing industry is $34.

- Employees in the manufacturing industry work an average of 40.2 hours per week.

- Women are underrepresented in the manufacturing workforce. According to the latest data from the U.S. Census Bureau, women make up 47% of the total American labor force but represent just 30% of manufacturing employees. Additionally, women represent only 23% of C-suite executives in industrial manufacturing and engineering.

Manufacturing Industry Size and Growth Statistics

Here are some highlights from the NIST Annual Report on the U.S. Manufacturing Economy, which depicts industry growth over the past several decades.

- In the U.S., the compound real annual growth (controlling for inflation) from 1996 to 2021 was 2.1%, placing the U.S. below the 50th percentile in terms of growth.

- Meanwhile, the compound annual growth from 2016 to 2021 was 2.2%, putting the U.S. slightly above the 50th percentile but still below the 2.9% world average.

- Manufacturing has grown to a record 17.5% of the global GDP, an increase from 13.7% in 1970.

- The U.S. accounts for 16.3% of the global manufacturing value added, behind China at 30.9%. Meanwhile, Japan creates 6.1%, Germany creates 4.9%, and South Korea creates 3.2%. India, the UK, Italy, France, and Indonesia round out the top 10.

- The U.S. ranked second in value added in all manufacturing subsectors except textiles and clothing, where it ranked fourth, behind India and Indonesia. China ranked first for all subsectors. Here’s the breakdown:

- High-tech manufacturing: China 29.5%; U.S. 19.1%

- Machinery and transport equipment: China 29.7%; U.S. 18.5%

- Food, beverages, and tobacco: China 25.8%; U.S. 22.7%

- Chemicals: China 26.6%; U.S. 24.3%

- Textiles and clothing: China 60.1%; U.S. 4.1%

- Other manufacturing: China 34.6%; U.S. 17.8%

Additive Manufacturing Statistics

Additive manufacturing is growing rapidly due to increased demand for prototyping applications across key industries, including automotive, healthcare, aerospace, and defense

Because of this demand, research and development in 3D printing is expected to drive the growth of the market.

Below is a summary of data about the additive manufacturing industry from a report by Grand View Research, which has the latest data available.

- In 2023, the global additive manufacturing market size reached $20.37 billion.

- North America represented 34% of the global revenue share in the market, larger than Europe and all other regions.

- The largest segment in the market was industrial 3D printers, accounting for more than 76% of the revenue share.

- Approximately 2.2 million 3D printers were shipped globally in 2021, with projections expecting an increase to 21.5 million units by 2030.

- The global additive manufacturing market is expected to reach $76.16 billion by 2030 at a CAGR of 23.3%.

Manufacturing Cybersecurity Statistics

Cybersecurity is essential in every modern industry, including manufacturing. The rise of operational technology and Industry 4.0 has increased reliance on networked devices, making critical infrastructure more susceptible to cyber threats.

The following manufacturing cybersecurity statistics illustrate the scope of the issue and provide actionable insights for manufacturing leaders to implement proactive solutions.

- According to a report from IBM, manufacturing was the most frequently attacked industry in 2021, representing 23% of ransomware attacks worldwide. Attackers aimed to exploit downstream supply chains to pressure manufacturers into paying the ransoms.

- Approximately 47% of ransomware attacks exploited vulnerabilities that had not been patched, emphasizing the importance of vulnerability management.

- Fortinet found that 61% of all security breaches on manufacturers in 2022 impacted operational technology (OT) systems.

- According to a survey from Sophos, the average ransomware cost in the manufacturing industry was $2 million per attack, among targets who paid the ransom. This is higher than any other industry and more than twice the cross-sector average of $812,360.

- Zscaler shows the manufacturing and retail industries represent 56.8% internet of things (IoT) traffic, surpassing enterprise (23.7%), entertainment and home automation (15.7%), and healthcare (3.8%). This underscores the need for cybersecurity protocols to secure IoT traffic in the manufacturing industry.

- A survey from Barracuda revealed that only 24% of manufacturing firms have completed their industrial internet of things (IIoT) or OT security projects, while 21% hadn’t even started them.

- A Barracuda report shows that 94% of organizations surveyed experienced a security incident over the past year. However, 75% of those that completed their OT and IIoT cybersecurity projects experienced no further impact from significant incidents.

- According to a study from Armis, 73% of OT devices are unmanaged, meaning they are completely unsecure. The study also found that only 51% of organizations have adequate cybersecurity expertise and 36% lack sufficient personnel.

AI in Manufacturing Statistics

AI algorithms can now analyze vast amounts of data, enabling manufacturers to prevent breakdowns before they occur.

These advancements are not just futuristic concepts but the current realities that AI brings to the manufacturing sector.

An impressive 93% of companies view AI as the key technology for driving growth and innovation in the manufacturing sector.

Artificial intelligence is already addressing some of the most pressing challenges manufacturers face today: process automation, market trends prediction, enhanced quality inspection, and increased product yield. The industry clearly sees AI as a transformative force.

But how exactly is AI used in manufacturing? What are the primary applications of this technology in the sector? The statistics below from WiFiTalents help answer these questions.

- 58% of manufacturers say AI will significantly improve customer satisfaction.

- Over 60% of manufacturers have adopted AI to enhance processes and productivity.

- In the automotive industry, AI can reduce production line downtime by 30-40%.

- The AI market in manufacturing is projected to reach $17.2 billion by 2025.

- Of surveyed supply chain professionals, 51% identify AI as a key component of their future strategy.

- More than 80% of manufacturers agree that AI solutions will make their work easier and more efficient.

- AI can boost production throughput by up to 15% and may reduce manufacturing downtime by 20%.

- Among organizations that have adopted AI in manufacturing, 74% report a return on investment (ROI) within two years.

- Implementing AI in the packaging process can reduce wastage and improve efficiency, saving up to 40% of materials.

- Organizations can cut costs by 25% by implementing AI-driven predictive maintenance.

Conclusion

The U.S. manufacturing industry stands at a pivotal juncture as it continues to drive global economic growth and innovation. The statistics and trends highlighted in this article emphasize the industry’s role and its evolving landscape.

As manufacturing output rises and the market steadily grows, companies must prioritize innovation, efficiency, and sustainability to maintain competitiveness.

Cybersecurity remains a significant concern as the integration of operational technology and Industry 4.0 increases vulnerability to cyber threats. Proactive measures and a thorough understanding of the cybersecurity landscape are crucial for safeguarding valuable infrastructure.

Staying informed about industry trends equips stakeholders with the knowledge to navigate the manufacturing industry’s future, support sustained growth, innovation, and resilience.

Custom Manufacturing with Fictiv

Fictiv is the operating system for custom manufacturing that makes it faster, easier, and more efficient to source and supply mechanical parts. Its intelligent platform, supported by best-in-class operations talent, orchestrates a network of highly vetted and managed partners around the globe for fast, high-quality manufacturing, from quote to delivery. To date, Fictiv has manufactured more than 25 million parts for early-stage companies and large enterprises alike, helping them innovate with agility and get products to market faster.Fictiv’s portfolio of optimized manufacturing services includes CNC machining, 3D printing, injection molding, and urethane casting.